Long-term stock holding keeps capital invested for years, allowing compounding, reduced trading and tax drag, and more rational choices to perform the hard work. Instead of pursuing short-term gains, automate contributions, reinvest dividends, and rebalance on a regular timetable. Risk persists, so diversify extensively and maintain a modest cash cushion to prevent forced selling when volatility subsides.

Holding investments for more than 12 months is part of a long-term investment strategy. This plan includes keeping things like bonds, stocks, exchange-traded funds (ETFs), mutual funds, and more. To take a long-term view, you need to be disciplined and patient. That’s because investors need to be willing to take some risks while they wait for bigger rewards later on.

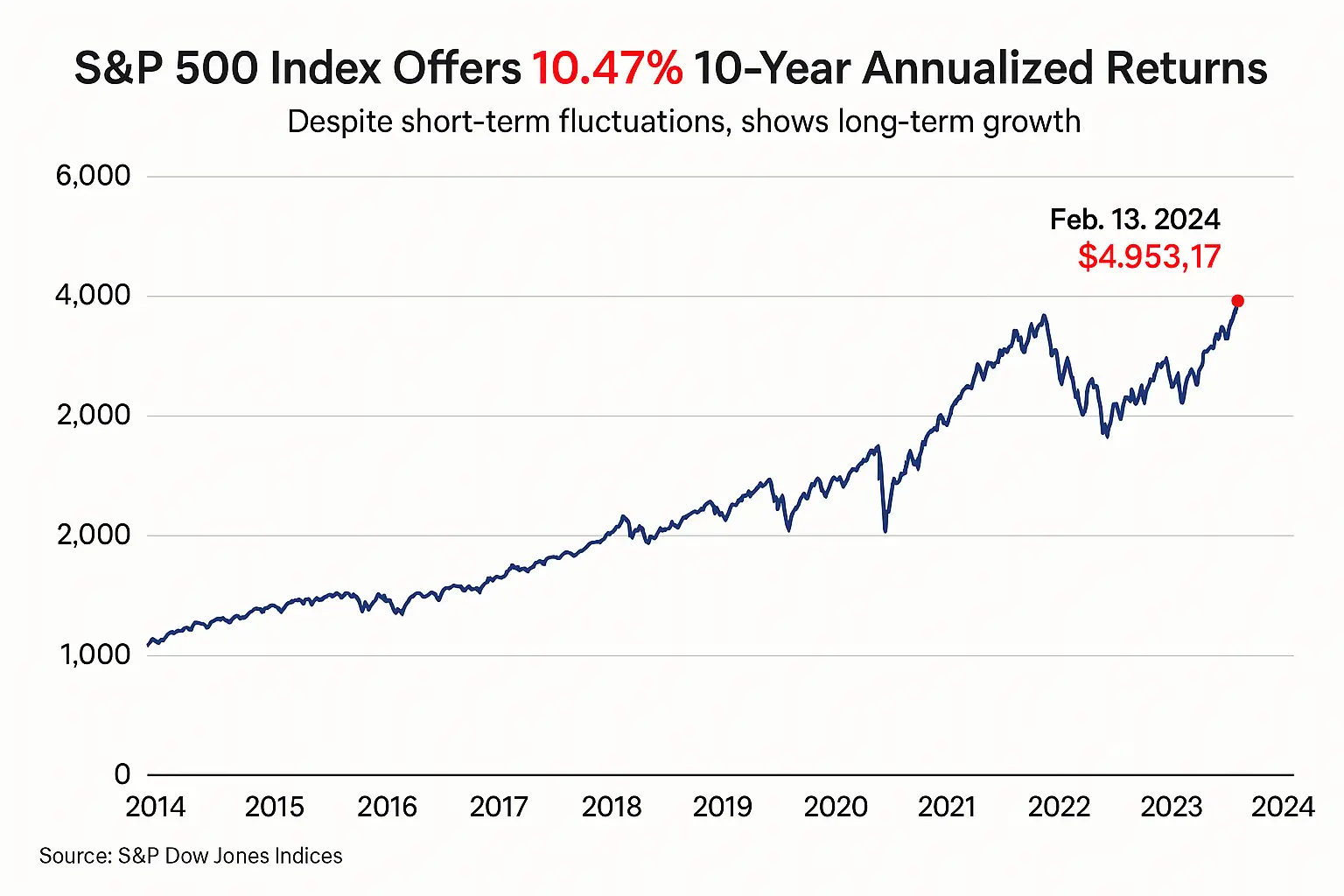

One of the best ways to build wealth over time is to buy stocks and keep them. The S&P 500 only lost money 13 times between 1974 and 2024, showing that the stock market makes money much more often than it doesn’t.

Key Points

- When it comes to timing the market, long-term stock investments usually do better than short-term trades.

- Emotional trading usually hurts investors’ returns.

- For most 20-year periods, the S&P 500 gave investors good returns.

- Many people think that being able to ride out temporary market drops is a sign of a good investor.

- Investing for a long time lowers costs and lets you reinvest dividends to make more money.

Higher Returns Over Time

An asset class is a group of investments that are similar to each other. They have the same traits and features, like bonds, which are fixed-income assets, and stocks, which are also known as equities. Your age, risk tolerance, investment goals, and the amount of money you have are just a few of the things that will help you decide what asset class is best for you. So, what kinds of assets are best for people who want to invest for a long time?

When we look at returns on different asset classes over the past few decades, we see that stocks have done better than almost all of them. The S&P 500 made an average of 9.80% per year from 1928 to 2023. This is better than the 3.30% return on three-month Treasury bills (T-bills), the 4.86% return on 10-year Treasury notes, and the 6.55% return on gold, to name a few.

Emerging markets have some of the highest return potentials in the equity markets, but also carry the highest degree of risk. Short-term changes do affect performance, though, because emerging markets are so volatile. Small and large caps usually give returns that are higher than average, but they are also more volatile.

Through highs and lows, you endure

People think of stocks as long-term investments. This is partly because equities can lose 10% to 20% or more of their value in a short amount of time. Investors can ride out some of these ups and downs for many years or even decades to get a higher long-term return.

People have rarely lost money investing in the S&P 500 for 20 years when looking back at stock market returns since the 1920s.

Investors would have made money if they had bought the S&P 500 and kept it for 20 years, even with problems like the Great Depression, Black Monday, the IT bubble, and the financial crisis.

Even though historical results don’t guarantee future returns, they do show that investing in stocks for a long time usually pays off if you give it enough time.

Decisions May Be Less Emotional and More Lucrative

Let’s face it: we’re not as calm and sensible as we claim to be. In fact, one of the inherent weaknesses in investor behaviour is an inclination to be emotional. Many people profess to be long-term investors until the stock market starts dropping, at which point they tend to withdraw their money to avoid further losses.

When stocks recover, many investors abandon their positions. In fact, they usually return after the majority of the gains have been made. This type of purchase high, sell low behaviour tends to slash investment returns.

According to Dalbar’s Quantitative Analysis of Investor Behaviour study, the S&P 500 generated an average annualised return of 9.65% over the 30-year period ending December 31, 2022. During the same period, the average equity fund investor earned an average annual return of approximately 6.81%.

There are several reasons why this occurs. Here are a few of them:

- Investors are afraid of regret. People often fail to trust their own judgement and instead believe the hype, particularly when markets fall. People sometimes get into the trap of believing that if they keep onto stocks, they will regret it and lose a lot more money as the stocks’ value drops, so they sell their holdings to alleviate this worry.

- Pessimism when things change. Optimism abounds during market rises, while the converse is true when things go wrong. Short-term surprise shocks, such as economic ones, may trigger market swings. However, keep in mind that these disruptions are often temporary, and things will most likely improve.

Investors who focus too much on the stock market reduce their chances of success by attempting to time the market too regularly. A basic long-term buy-and-hold strategy would have produced far greater earnings.

Lower Capital Gains Tax Rates

Profits from the selling of capital assets result in a capital gain. This includes any personal possessions, such as furniture, as well as investments in stocks, bonds, and real estate.

When an investor sells a financial asset after holding it for less than a year, the gains are taxed at the same rate as regular income. These are known as short-term capital gains. Depending on the individual’s adjusted gross income (AGI), this tax rate might reach 37%.

Any stocks sold after being held for more than a year generate long-term capital gains. The profits are taxed at a maximum rate of just 20%. Investors in lower tax rates may be eligible for a 0% long-term capital gains tax rate.

Increased cost effectiveness

One of the primary advantages of a long-term investing strategy is financial. Keeping your stocks in your portfolio for a longer period of time is less expensive than buying and selling on a regular basis since the longer you retain your assets, the less fees you will incur. But how much does all this cost?

As we said in the last section, you save on taxes. Gains from stock transactions must be reported to the Internal Revenue Service (IRS). This increases your tax obligation, requiring you to pay extra money out of pocket. Remember that short-term financial gains may cost you more than holding your assets for a longer length of time.

Then there are trade or transaction fees. How much you pay is determined on the kind of account you have and the investment company that manages your portfolio. For example, you may be charged a commission or a markup, with the former subtracted when you purchase and sell via a broker and the latter levied when the transaction is made through their own inventory. These fees are applied to your account everytime you trade equities. This implies that each sell reduces your portfolio balance.

Many active investors now trade using internet brokerages that provide fee-free transactions. In certain instances, you may not pay any charges while completing any or all of your deals. However, investors should measure the worth of the time they spend on trades against the difference in performance between an active and a longer-term, buy-and-hold strategy.

Fast Fact: Account maintenance fees might reduce your account balance. So, if you’re a frequent trader with a short-term aim, your costs will increase much more if transaction fees are taken into account.

Benefit from Compounding with Dividend Stocks.

Dividends are earnings dispersed by firms having a proven track record of profitability. These are often blue-chip or defensive equities. Defensive stocks are those that perform well regardless of the economy’s performance or when the stock market falls.

These firms pay regular dividends to qualifying shareholders (typically every quarter), allowing you to partake in their success. While it may be tempting to cash them out, there is a compelling reason why you should reinvest your dividends in the firms that pay them.

If you hold bonds or mutual funds, you’ll understand how compound interest impacts your assets. Compound interest is any interest computed on the principle balance of your stock portfolio plus any previous interest earned. This implies that any interest (or dividends) earned by your stock portfolio compound over time, eventually increasing the amount in your account.

Best Stocks to Hold for Long Term

When deciding to buy stocks, there are various factors to consider. Consider your age, risk tolerance, and investing objectives, among other factors. Having a grip on all of this will help you determine the kind of stock portfolio you can build to fulfil your objectives. Here’s a broad guide you may use as a starting point and adapt to your own situation:

- Select index funds. These are exchange-traded funds that follow certain indexes, such as the S&P 500 or the Russell 1000, and trade like stocks. However, unlike stocks, these funds are less expensive and do not need you to choose particular firms in which to invest. Index funds provide comparable returns to the indices they monitor.

- Consider dividend stocks. These companies may help increase the value of your portfolio, particularly when dividends are reinvested.

- Companies with rapid growth may help your portfolio. Growth stocks are often connected with firms that can create much more revenue and at a quicker pace than competitors. They are also better prepared to provide excellent profit reports. Keep in mind, however, that this amount of development entails a larger level of risk, so you’ll need to be more savvy than inexperienced investors if you want to go this path.

As always, get advice from a financial expert, particularly if you are new to the investing world.

What Are the Tax Benefits of Long-Term Stock Holding?

The IRS taxes capital gains on both short-term and long-term holdings. Short-term capital gains are taxed on assets sold within one year of ownership, while long-term profits are taxed on assets sold after more than 12 months of ownership.

Short-term capital gains are considered ordinary income, which means you might be taxed up to 37% depending on your tax status. Long-term profits, on the other hand, are taxed at zero, fifteen, or twenty percent. The rate is based on your adjusted gross income and filing status.

How Long Must You Hold a Stock to Be Considered Long-Term?

To be considered a long-term investment, a stock must be held for at least 12 months, just like any other asset. Anything below that is considered a short-term holding.

Can you sell a stock just after you buy it?

The broker determines how long you may wait to sell the stock after you bought it. Some businesses ask you to wait a particular period of time (at least until the settlement date) before selling your shares. Others enable a limited number of same-day transactions inside your account. People that make more than the authorised number of transactions in a single day are referred to as day or pattern traders, and they are often obliged to maintain a minimum account balance.

Time in the Market Wins

A patient, rules‑based plan does most of the heavy lifting: automate contributions, reinvest dividends, and rebalance on a schedule while ignoring short‑term noise. Long horizons don’t erase risk, so diversify broadly and keep a small cash buffer to avoid forced selling. If taxes apply in the reader’s country, favor long‑term holding to reduce tax drag—then let time and compounding work.

▾ ARTICLE SOURCES

We cite primary sources where possible and reputable publishers for context.

⚠️Disclosure

This article is for informational purposes only and is not financial, investment, tax, or legal advice. Markets involve risk, including possible loss of principal. Past performance does not guarantee future results. Consider independent professional advice and your personal circumstances before investing.