Exchange

Exchange

BitMart Exchange Review 2025

- BitMart is a global exchange with over 12 million registered users and mid-tier trading volumes.

- It offers thousands of pairs across spot and futures markets, as well as instant fiat payments.

- The exchange doubles as a DeFi ecosystem with staking, savings accounts, and decentralized loans.

BitMart, a worldwide cryptocurrency exchange and derivatives platform, was created in 2017. While it boasts over 12 million users globally and mid-tier liquidity, cryptocurrency traders should read our BitMart review before making a judgement.

We examined the BitMart exchange on desktop and mobile devices to assess the overall user experience, trade execution times, and fundamental platform features like as fees, supported markets, and charting tools.

Continue reading to find out whether BitMart is the correct exchange for you or if there are other options available in 2025.

What is BitMart?

- BitMart is a global cryptocurrency exchange where you can buy, sell and manage digital assets on web and mobile.

- It has spot, margin and futures trading as well as savings, staking and NFT and inscription marketplace to get more people involved in crypto.

- BitMart was founded in 2017 and serves many countries. Its native utility token BMX gives users trading discounts and other benefits in the ecosystem.

- Easy buy/sell flows for beginners and advanced charting, order types and APIs for professional traders and developers.

BitMart is an established cryptocurrency exchange with over 12 million customers. BitMart, based in the Cayman Islands, offers a diverse selection of cryptocurrency goods and services. Spot trading is the exchange’s most popular service, with over 1,700 supported markets and an average daily turnover of $3 billion.

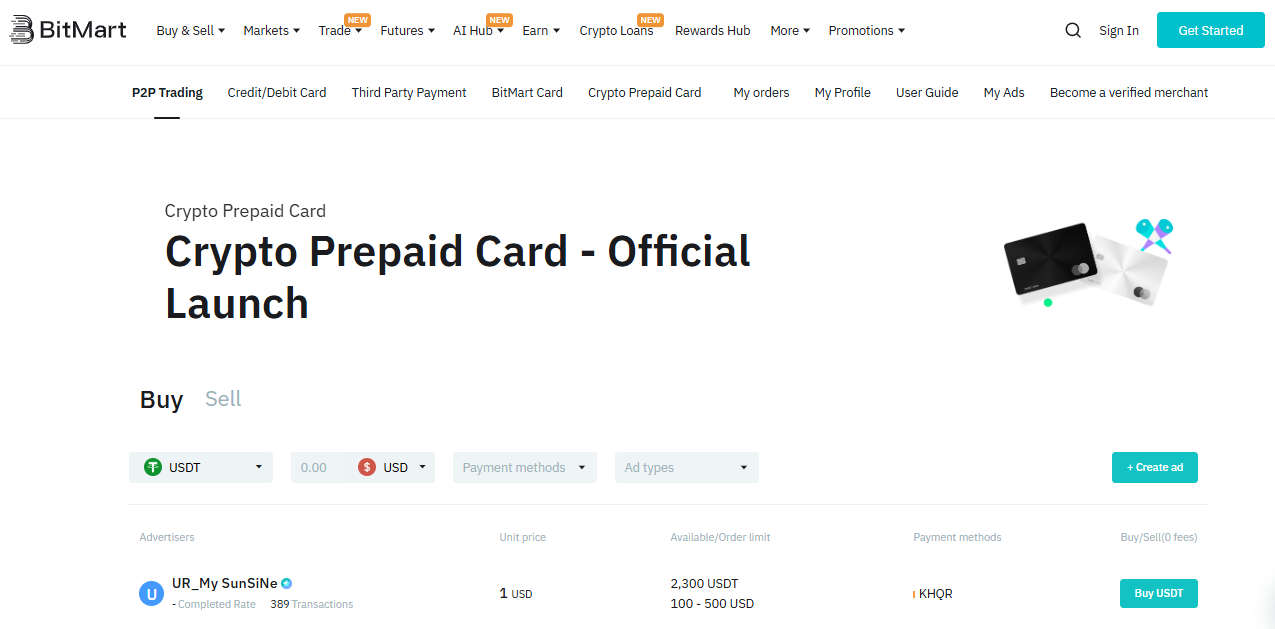

The platform also provides derivative trading via linear and inverse contracts, as well as AI-powered tools for real-time market data. Beginners also use BitMart to acquire cryptocurrencies instantaneously using debit/credit cards, e-wallets, and peer-to-peer payments. According to research, BitMart also features a burgeoning decentralised finance (DeFi) ecosystem, which includes cryptocurrency loans and savings accounts.

Users may access all BitMart markets and trading tools via a single account, whether on the desktop website or the native iOS and Android apps.

While BitMart stands out for its vast asset support and product assortment, users do not have the same regulatory safeguards as those on tier-one exchanges. It lacks license, excluding accounts from the United States, the United Kingdom, and other important economies.

BitMart Exchange Review: Pros and Cons

BitMart’s main strength is its vast variety of markets. Traders have access to over 1,700 digital assets on the spot exchange platform, as well as over 460 perpetual futures markets with up to 200x leverage. The rapid purchase function benefits novices who want to invest using debit or credit cards, indicating that BitMart is suitable for all skill levels.

Other areas where the exchange falls short include excessive fees when trading low-cap pairings and decreased leverage on markets with low liquidity. BitMart likewise operates without a robust regulatory structure. It lacks licenses and has not released Merkle-Tree proof of reserves.

Pros

- Buy and trade more than 1,700 cryptocurrencies.

- Trade hundreds of perpetual futures using leverage.

- Accepts debit/credit card and peer-to-peer payments.

- Established in 2017.

- Provides high-yield DeFi products, including savings accounts and staking.

- Get quick cryptocurrency loans without a credit check.

Cons

- High spot costs for non-major pairings.

- There are no delivery futures, and smaller coins have decreased leverage.

- Reputation harmed by the Bitmart breach (for $200 million) in 2021.

- Not available in the United States or United Kingdom.

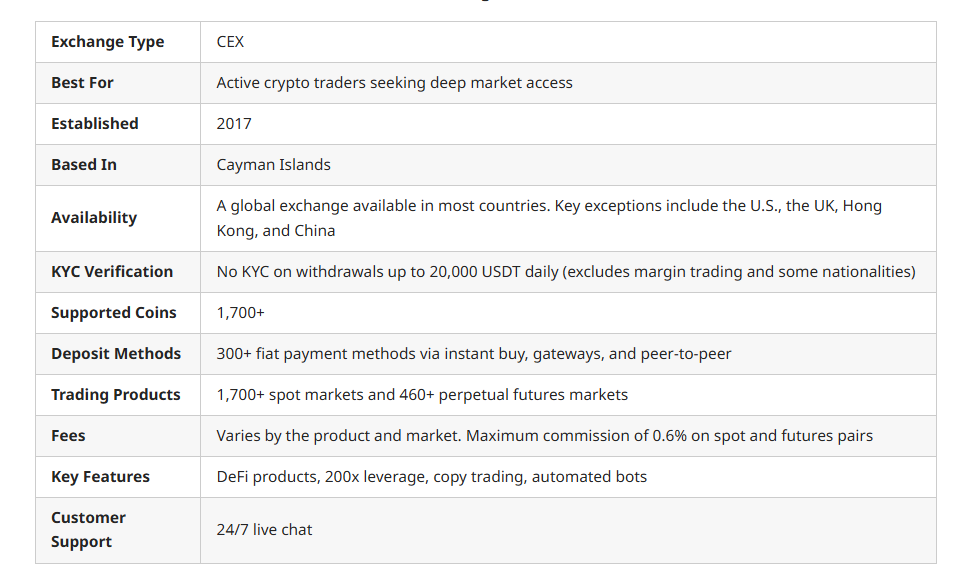

Bitmart Exchange Overview

BitMart isn’t only a bitcoin exchange. Its ecosystem provides access to fiat payments, perpetual futures with leverage, and automated services like as copy trading and grid bots.

The following table summarises our BitMart review findings:

Is BitMart safe?

BitMart operates an established exchange with millions of active platform users. Unlike Coinbase, Gemini, and other tier-one exchanges, BitMart is unregulated. Its unregulated structure allows it to serve a worldwide audience and provide products such as futures and cryptocurrency loans without requiring tight compliance.

Although BitMart lacks proof of reserves, the exchange has lately revealed intentions to develop a Merkle tree mechanism. In the interim, it offers wallet addresses for Bitcoin, Ethereum, and BNB. However, such addresses only cover hot wallet storage, which represents a minor portion of BitMart’s total exchange reserves.

In terms of track record, thieves compromised BitMart’s systems in a 2021 hack. The “51% Attack” resulted in the loss of approximately $200 million, however BitMart has vowed to compensate impacted accounts.

The exchange has subsequently improved its security standards. Account holders may safeguard their accounts using phone and email confirmations, as well as two-factor authentication with Google Authenticator. Other account security measures include device whitelisting and anti-phishing codes.

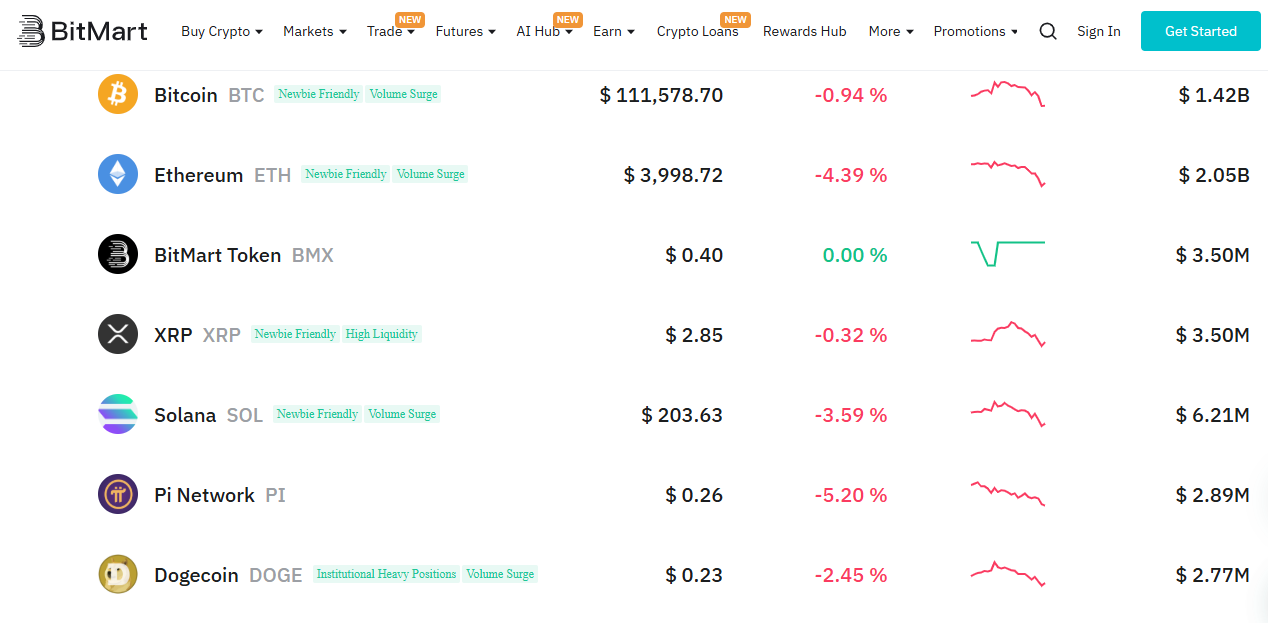

BitMart supports coins and trading pairs.

BitMart covers more than 1,700 coins. Users exchange Bitcoin (BTC) and the greatest cryptocurrencies, such as Ethereum (ETH), Tron (TRX), Solana (SOL), and Sui (SUI), for USDT. The portal also includes the greatest meme currencies, like Bonk (BONK), Shiba Inu (SHIB), Pepe (PEPE), and dogwifhat (WIF).

The spot exchange allows users to search for markets by investment type, with choices including RWA, Layer 1, Layer 2, and DeFi. Another approach is to look at trending tokens from certain ecosystems like as Ethereum, Base, and BNB Chain.

BitMart is also well-known for identifying new cryptocurrencies due to its large number of marketplaces. Clicking the “Innovation” option exposes micro-cap cryptocurrencies with high potential, however some marketplaces have little trading volumes.

Our BitMart study discovered that the exchange also supports crypto-to-crypto pairings, such as SOL/BTC and ETH/BTC. Although consumers may buy digital assets using their local currency, BitMart does not allow fiat-to-crypto pairings such as BTC/USD or ETH/EUR.

Bitmart Trading and Investing

BitMart individuals with minimal trading knowledge purchase cryptocurrency using rapid payment options. As a first-time investor, this is the most straightforward approach to get into the cryptocurrency market.

The instant purchase tool supports about 20+ cryptocurrencies, with a minimum investment of $11 (or cash equivalent). To finalise an order, users submit the asset, purchase amount, and deposit method, as well as their payment information. BitMart adds those cryptocurrency to the user’s account right away, enabling newcomers to avoid the order book method.

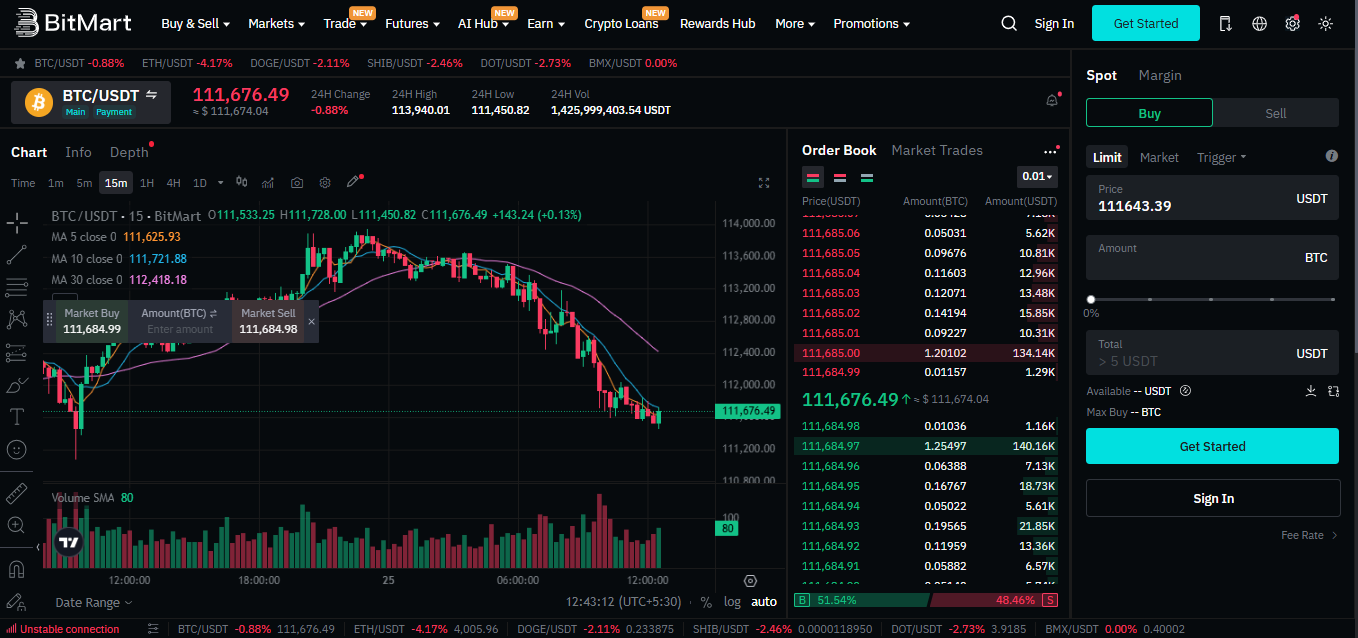

Spot and Margin Trading

While the fast purchase option makes trading easier, the spot exchange offers reduced costs and a larger range of markets.

With an average daily trading volume of several billion dollars, BitMart’s spot exchange is perfect for achieving narrow spreads using limit and market orders. The trading dashboard includes charting indicators, complex trading tools (including order kinds), and drawing tools such as Fibonacci rings and trend lines. The order book is accessible and customisable, allowing traders to assess buying and selling patterns.

The spot platform also serves as a margin trading facility. This capability allows for isolated leverage of up to 5x, and often 3x on smaller markets. Traders may purchase cryptocurrencies with more money than their BitMart account permits, but like with perpetual futures, they risk liquidation and additional costs.

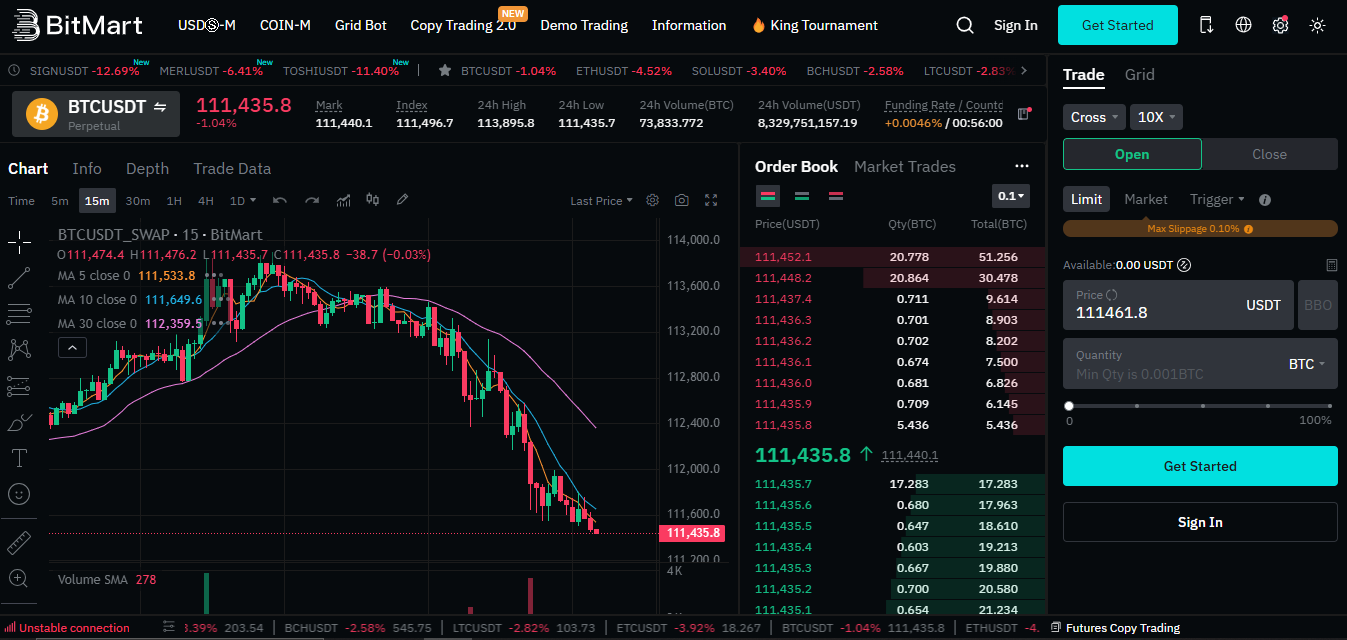

Futures

BitMart traders may access over 460 perpetual futures markets. There are two contract types available: USD-M and coin-M.

USD-M futures are settled in Tether (USDT) or USDC (USDC) for convenience and risk minimisation. Traders only risk the initial margin on futures positions, and they may choose from a far larger selection of markets.

Coin-M futures settle in the underlying asset, with just BTC and ETH remaining as options.

In preparing this BitMart evaluation, we confirmed the maximum leverage as 200x. However, the exchange has far lower limitations in non-major markets. It also limits leverage on Coin-M futures to 50 times BTC/USDT. To see the leverage limit for your selected futures market, choose the “10x” option at the top of the order form.

After reviewing the top crypto futures platforms in 2025, we concluded that CoinFutures is a better option for the majority of traders. Maximum leverage restrictions remain at 1000x across all markets, including volatile pairings such as DOGE/USDT. CoinFutures also provides clear evidence of reserves, something BitMart has yet to reveal.

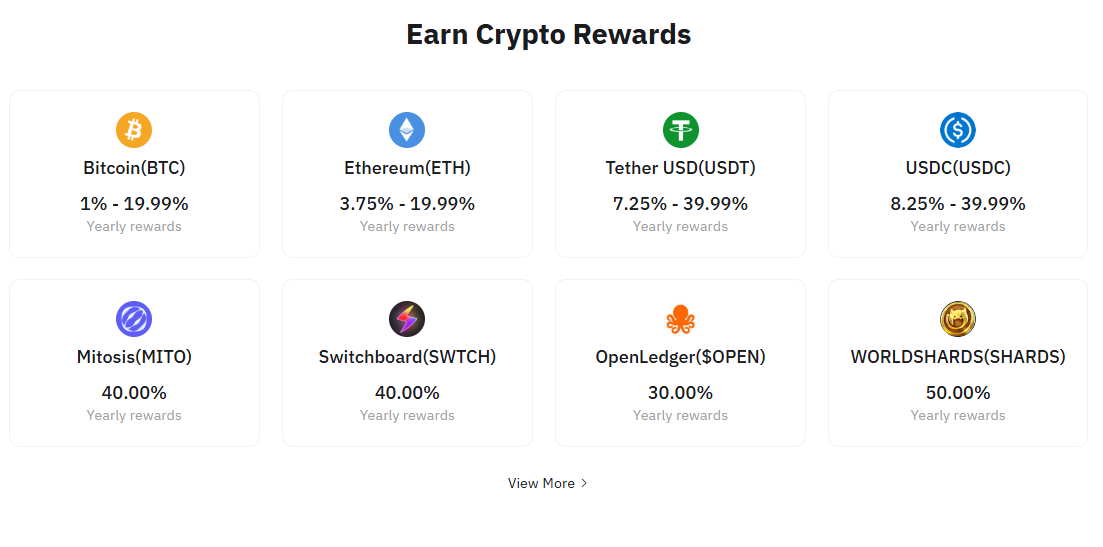

BitMart Earn

BitMart Earn provides a wide variety of DeFi services. No other account is required, allowing users to allocate cash straight from their BitMart balance.

One prominent product is BitMart’s savings accounts, which have both variable and set periods. Flexible accounts provide 15% APYs on USDT, USDC, BTC, ETH, SOL, and XRP.

The caveat is that the 15% rate applies only on the first part of the entire investment. USDT deposits, for example, fall to 6.25% after the first 200 USDT. Bitcoin APYs drop to 1% after the first 0.002 BTC. Fixed accounts also provide excellent APYs, albeit consumers cannot withdraw their funds until the period is over.

The exchange also supports customers that prefer the proof-of-stake approach. ETH staking earns 4%, while SOL gives 8.25%. BitMart does not impose minimums, lock-up periods, or fees on staked coins.

Rewards and Promotions.

BitMart provides first-time clients with welcome bundles worth at up to 14,000 USDT. Users may get a variety of benefits based on the job they do. The lower-value vouchers are the simplest, since they need account authentication, a deposit of 100 USDT or more, and the placement of a spot trade order.

BitMart offers periodic incentives for current traders, including as spot and futures prize drawings. The winning products include 0.1 BTC, 100 USDT, and an iPhone 16 Pro.

The events centre provides extra chances, including as full-fledged trading tournaments for new token listings. Projects benefit from larger trade volumes, and consumers get free tokens just by participating.

Bitmart AI Hub

BitMart utilises artificial intelligence (AI) capabilities to give real-time insights. We analysed each tool and discovered that the use cases are rather simple. The 24-hour social sentiment tool, for example, reveals whether postings are bullish, bearish, or neutral; nevertheless, the data is not reliable. It only examines 7-8,000 postings, which represents a tiny portion of the entire X activity.

The site also analyses market pulse rankings (MPR) and top key opinion leaders (KOL) in cryptocurrency, however similar figures can be found on many other data aggregation platforms.

Beacon, the exchange’s ChatGPT-style bot, allows customers to ask market-related enquiries in a conversational way. The AI technology also assists users with trading strategy and risk management.

BitMart’s AI hub also offers copy trading and grid bots, however these capabilities are based on conventional automation rather than pure AI.

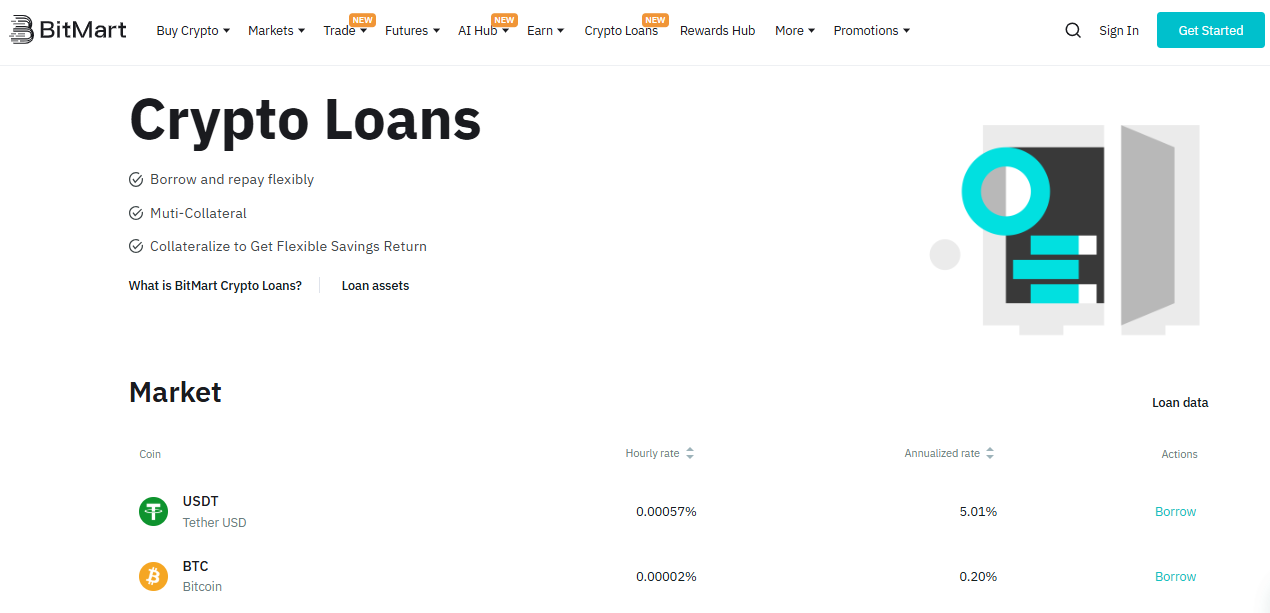

Bitmart Crypto Loans

While BitMart is most recognised for its high-volume spot exchange, it is also a top cryptocurrency loan platform.

It provides secured loans with a maximum loan-to-value (LTV) of 65%. This framework allows users to borrow 650 USDT with a 1,000 USDT collateral deposit. To reduce risk, lesser-cap coins have lower LTVs.

BitMart, like other cryptocurrency loans, does not need any credit checks or application procedures. Simply deposit the security and get the loan cash promptly.

Interest rates are variable and depend on the currency or token. The APRs for Bitcoin and Ethereum are only 0.2% and 0.7%, respectively. USDT loans are more costly, at 3.32%, although they remain competitive when compared to conventional lenders.

If you borrow a non-stablecoin asset, keep in mind the dangers of liquidation. Liquidation happens when the initial collateral value is no longer sufficient to support the maintenance margin. The safest alternative is to borrow stablecoins, which are tethered to the US dollar.

Bitmart Trading Fees

Our BitMart exchange evaluation includes sections on trading and non-trading costs.

Spot Trading Fees

BitMart features an innovative spot trading commission system that levies fees depending on pair type.

The greatest cryptocurrencies to purchase, including as BTC, ETH, and SOL, are under class A. This class is the cheapest, with customers paying just 0.1% each slide. Commissions in classes B, C, and D rise to 0.25%, 0.4%, and 0.6%, respectively. This structure makes low-cap cryptocurrencies more costly to trade, since 0.6% is much more than the market average.

BitMart provides two strategies to cut spot trading charges. Account holders holding BitMart Token (BMX) get a 25% discount. Those that issue limit orders (market makers) also pay lesser fees, but they must achieve minimum 30-day trading volumes to qualify.

In our 2025 market research, we evaluated the cryptocurrency exchanges with the lowest fees.

Margin Trading

Margin costs are comparable to spot trading commissions, but customers pay extra fees on borrowed cash.

When users open orders, BitMart applies initial interest rates, and the charge varies depending on the asset. Users pay extra rollover interest rates on an hourly basis, making margin positions costly to retain over time.

Futures Trading Fees

BitMart traders pay 0.06% per side for trading perpetual futures using market orders. These commissions are reduced to 0.02% for limit orders.

There are no extra reductions available until you reach VIP level 13, which requires institutional-grade volume.

We tried a fiat transaction while writing this BitMart evaluation. The platform provided a price of 94.87 USDT for a $100 Visa buy. This is a large spread of around 6% below the market price.

Depending on your currency, purchasing cryptocurrency using BitMart’s peer-to-peer dashboard is typically less expensive.

Non-trading Fees

BitMart users may be required to pay cryptocurrency deposit fees depending on the asset. For example, although major cryptocurrencies like as BTC, SOL, and USDT are cost-free, the exchange charges a 2% fee for deposits of 10Set Token.

Bitmart’s trading costs are based on the local currency or token. Users pay 0.0001 BTC to withdraw Bitcoin, which is equivalent to around $11. Tether withdrawals range from 1 to 2 USDT, depending on the network.

Make sure to check the minimum withdrawal threshold. While USDT withdrawals on the BNB Chain have a 2 USDT minimum, utilising the Solana blockchain raises the amount to over 25 USDT.

Is BitMart user-friendly?

We discovered that user-friendliness differs according on the BitMart product. Beginners purchase digital goods using standard payment methods, eliminating the learning curve. The order form is similar to a traditional online purchase in that it simply asks for the cryptocurrency, amount, and deposit method.

The spot exchange remains user-friendly, but users must have a basic grasp of market and limit orders. The charting section has basic navigation and customisation options for colours, timeframes, and widget positions.

The perpetual futures platform follows the same layout as the spot exchange. Futures trading is far more complicated than ordinary trading, so traders must understand margin requirements and liquidation risks.

While the desktop version is the most efficient method to trade, BitMart’s iOS and Android mobile apps provide a streamlined and hassle-free experience. Our BitMart app review reveals that it’s great for fast purchasing or selling cryptocurrencies and reviewing portfolio values while on the go.

BitMart Customer Service and User Reviews

According to our BitMart review, consumers may get live chat help 24 hours a day, seven days a week. We were first connected to an AI chatbot but were quickly moved to a live representative within seconds. Responses were prompt, professional, and good.

The biggest concern is BitMart reviews in the public domain. Google Play and App Store users rate the app 3.5/5 and 3.7/5, respectively. BitMart has a Trustpilot rating of 3.1/5 based on almost 3,000 independent reviews.

Best BitMart Alternatives

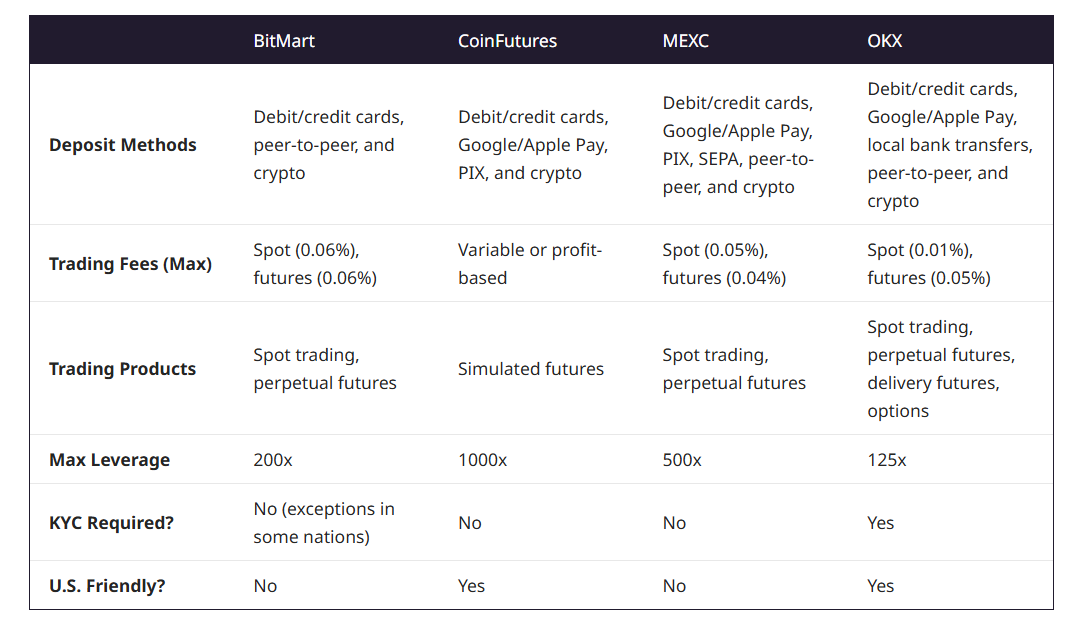

The table below compares BitMart to the top cryptocurrency exchanges based on key criteria such as trading fees, supported markets, and maximum leverage. To make an educated selection, consider the following key indicators.

How to Get Started with BitMart

It just takes a few minutes to create a BitMart account and start buying or trading cryptocurrencies. Here’s a step-by-step guide to getting you set up.

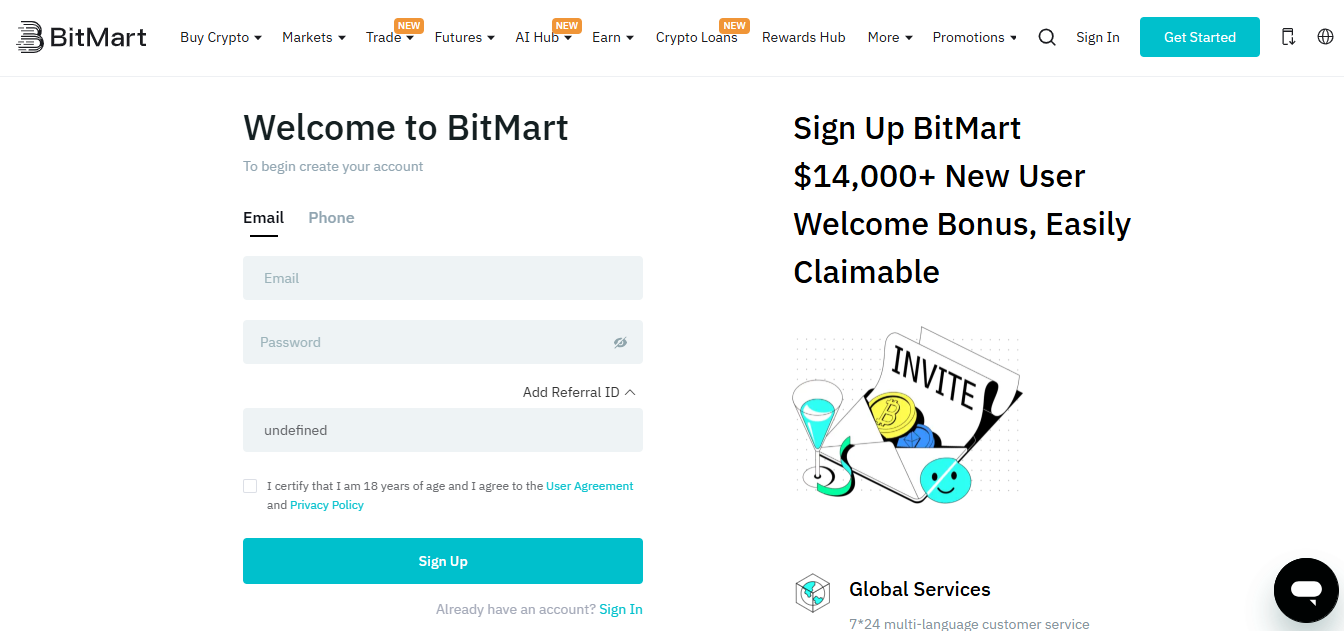

Step 1: Open a BitMart account.

Visit BitMart to create a new account. Simply provide an email address or phone number and a password.

Then confirm the email/number via the verification code. That’s all it takes to join BitMart.

Step 2: Deposit Cryptocurrency

If you already have cryptocurrency, this is the cheapest method to put it into your BitMart account. If not, you may skip this step and utilise fiat money.

Hover over the profile symbol and choose “Deposit”. Select the currency or token from the drop-down list, then the network. BitMart displays the account deposit address in a lengthy format and a QR code. Transfer assets to the location and let a few minutes for BitMart’s servers to credit the payment.

Step 3: Purchase Crypto using Fiat Money.

To purchase cryptocurrency using a Visa or MasterCard, hover over “Buy & Sell” and choose “Credit/Debit Card”. Input the currency (e.g., EUR), cryptocurrency (e.g., BTC), and buy amount. BitMart indicates the amount of cryptocurrency you will get for that amount.

Check the currency rate to make sure you’re satisfied with the pricing. To continue, enter your payment information and confirm the order. BitMart handles the transaction promptly.

Step 4: Trade Cryptocurrency

BitMart customers may trade bitcoins with much cheaper costs on the spot market. Select “Spot” from the “Trade” menu, then select your favourite pair.

If you’re a newbie, set the order type to “Market” on the right-hand dashboard. This order guarantees that your deal executes promptly at the best market rate, eliminating the need to wait for another exchange user to approve your pricing.

▾ ARTICLE SOURCES

We cite primary sources where possible and reputable publishers for context.

⚠️ Disclosure