Bitcoin ETFs post a record $241M — After two days of redemptions, US spot Bitcoin ETFs saw a big inflow of $241M on September 24, led by BlackRock’s IBIT with $128.9M, as total Bitcoin ETF assets approached $150B and market focus shifted to macro and liquidity, while Ethereum products saw outflows.

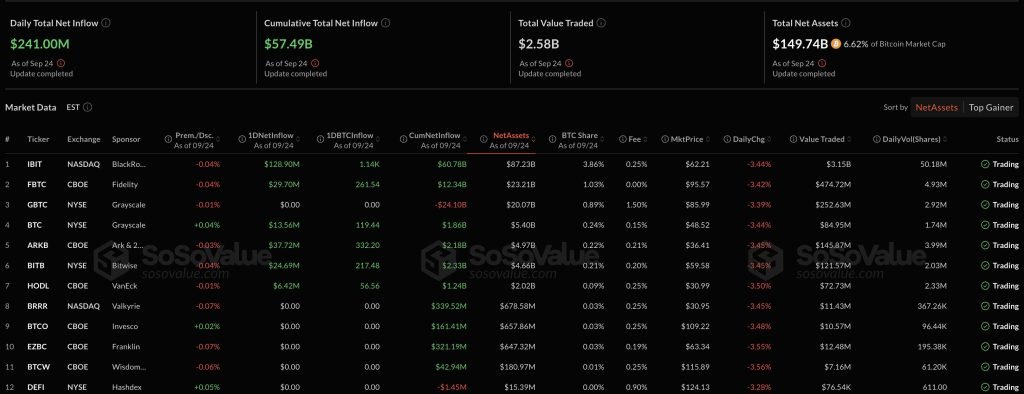

Bitcoin exchange-traded funds (ETFs) rebounded dramatically on September 24, with net inflows of $241 million after two days of investor withdrawals, according to SoSoValue statistics.

The reversal follows a combined $244 million in withdrawals on September 23 and a bigger $439 million leave the day before, as markets responded to the Federal Reserve’s recent rate decrease and anticipated new US inflation data.

Bitcoin ETF holdings approach $150 billion after strong daily inflows.

BlackRock’s iShares Bitcoin Trust (IBIT) received the most inflows yesterday ($128.9 million), raising its overall net inflows to $60.78 billion and total net assets to $87.2 billion.

Ark Invest and 21Shares’ ARKB followed with $37.7 million in net inflows, bringing the total to $2.18 billion. Fidelity’s FBTC garnered $29.7 million, while Bitwise’s BITB brought in $24.7 million.

VanEck’s HODL had a smaller influx of $6.4 million, while Grayscale’s BTC fund received $13.5 million.

Bitcoin spot ETFs currently have a total asset value of $149.7 billion, which accounts for 6.62% of Bitcoin’s market capitalisation.

Cumulative inflows was $57.49 billion, while daily trading activity on September 24 was $2.58 billion.

The revived demand demonstrates Bitcoin goods’ resiliency after hefty redemptions earlier this week. On September 23, Bitcoin ETFs dropped $103.6 million, topped by Fidelity’s FBTC (-75.6 million) and ARKB (27.9 million).

That followed a more steeper session on September 22, when Bitcoin funds lost $363 million, including $276.7 million from Fidelity’s FBTC alone.

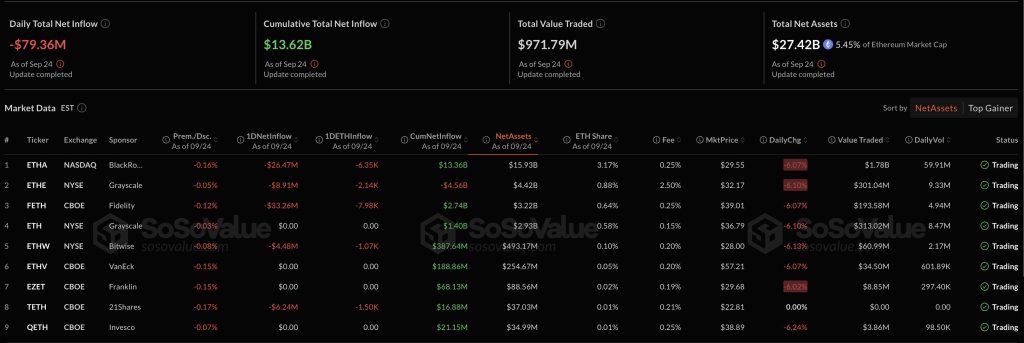

However, Ethereum ETFs continued to see inflows. On September 24, ETH products received $79.4 million in net redemptions, continuing a pattern of consistent investor withdrawals.

Fidelity’s FETH had the greatest daily outflow, $33.2 million, followed by BlackRock’s ETHA, $26.5 million, and Grayscale’s ETHE, $8.9 million.

Bitwise’s ETHW lost $4.5 million, whilst VanEck’s ETHV and Grayscale’s ETH fund had no noteworthy movements.

The redemptions follow significant losses earlier in the week. On September 23, Ethereum ETFs experienced $140.7 million in withdrawals, led by Fidelity’s FETH at $63.4 million, followed by Grayscale’s ETH product at $36.4 million and Bitwise’s ETHW at $23.9 million.

On September 22, ETH funds reported $76 million in withdrawals, headed once again by Fidelity.

As of September 24, Ethereum spot ETFs had $27.4 billion in assets, accounting for 5.45% of ETH’s entire market value. Despite the current surge of redemptions, cumulative inflows have reached $13.6 billion.

Institutional pause weighs on Bitcoin—Armstrong still predicts $1 million BTC.

Institutional demand for Bitcoin has cooled after a robust start to September, with spot ETF inflows declining dramatically.

According to Glassnode, net inflows fell 54% last week to $931.4 million from $2.03 billion the previous week.

Analysts believe the slowing indicates a break in institutional purchasing, even if total accumulation remains intact.

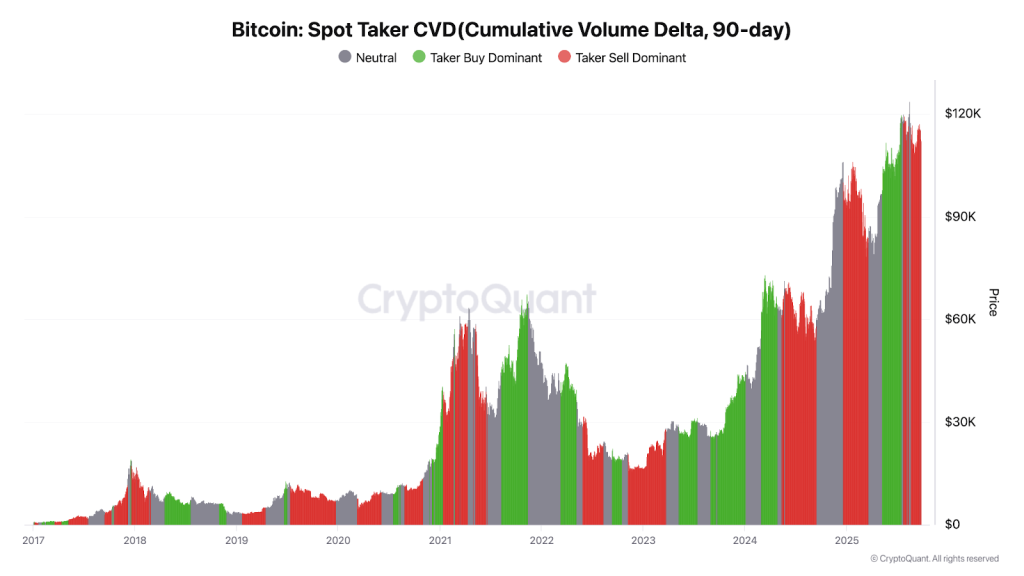

Earlier this month, Bitcoin’s rise above $118,000 was accompanied by massive ETF inflows, including $741 million in a single day. But momentum has evaporated as regular traders continue to sell.

CryptoQuant’s spot taker CVD indicator has been sell-dominant since mid-August, indicating the prospect of a further fall into October if flows do not return.

Bitcoin is now trading below $110,600, down 6.9% in 24 hours.

Ethereum has also been under intense criticism. Ether went below $4,000 on Thursday, resulting in a $36.4 million liquidation of one huge position and adding to a $331 million long squeeze over the previous day, according to CoinGlass data.

Over the last week, ETH traders have witnessed $718 million in long liquidations and $79.6 million in shorts. The cryptocurrency is now trading at $3,882, down 7.3% in 24 hours and 15% for the week.

Despite the short-term setback, hope remains. Coinbase CEO Brian Armstrong said that Bitcoin might reach $1 million by 2030, citing advancements in U.S. law, possible government acceptance, and growing institutional interest.

With ETF custody already centred on Coinbase, he claimed that long-term fundamentals remain solid as supply tightens and sovereign demand may develop.

▾ ARTICLE SOURCES

We cite primary sources where possible and reputable publishers for context.

⚠️ Disclosure